Benefits of Using Loan Apps Over Traditional Banks – Comprehensive Guide 2025

Benefits of Using Loan Apps : In 2025, financial inclusion in India and across the globe is undergoing a dramatic transformation. One of the most notable developments is the rapid adoption of loan apps—mobile-based platforms offering instant personal loans—over traditional banking institutions. The benefits of using loan apps over traditional banks are increasingly evident, especially among millennials, gig workers, and small business owners who seek faster, simpler, and more accessible credit options.

Table of Contents

This comprehensive guide explores the major advantages of using loan apps in 2025, how they differ from traditional bank loans, the technology driving them, and how borrowers can use them wisely. With high-reaching keywords, practical insights, and case studies, this essay will serve as a definitive resource for anyone looking to explore the future of digital lending.

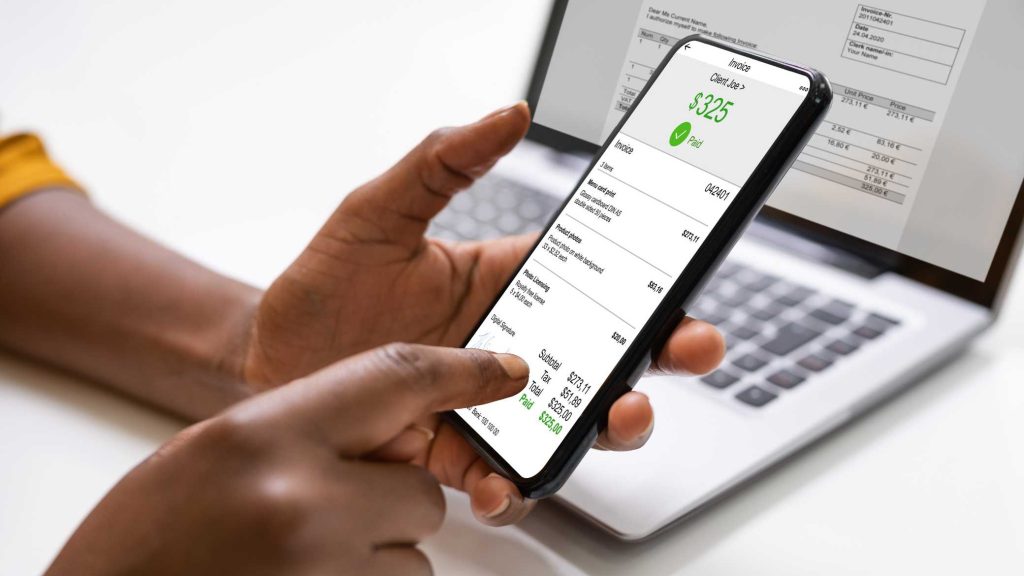

1. Speed and Convenience: Instant Loans at Your Fingertips

No More Long Queues

Traditional banks typically require multiple visits, extensive paperwork, and long waiting periods. In contrast, loan apps provide instant approvals, often within minutes, using automated credit assessment tools.

24/7 Accessibility

Loan apps are available 24/7, allowing users to apply for loans anytime, anywhere—especially helpful during emergencies or outside banking hours.

User Stories

Many users report success stories such as securing a ₹50,000 emergency medical loan in under 10 minutes using platforms like KreditBee or EarlySalary.

2. Minimal Documentation Requirements

Paperless Onboarding

Most loan apps require just a PAN card, Aadhaar number, and income proof, enabling faster onboarding without physical documentation.

Automated Verification

Thanks to eKYC (Electronic Know Your Customer) and AI-based verification systems, documentation is verified within seconds, making the application process seamless.

What It Means for Users

First-time borrowers, especially in Tier 2 and Tier 3 cities, find this feature useful as they often lack access to printers or photocopying services.

Read more: FlexPay Personal Loan – Get Upto ₹3,00,000 Personal Loan : Comprehensive Guide

3. Faster Disbursal Times

Same-Day Disbursal

Unlike traditional banks that may take 3–7 days, loan apps often disburse funds within minutes or a few hours.

Real-Time Updates

Users receive notifications about application status, approval, and fund disbursal in real-time, adding transparency and assurance.

Real-Life Scenario

Startups like PaySense, CASHe, and Nira boast average disbursal times of under 30 minutes, even for loan amounts exceeding ₹1,00,000.

4. Flexible Loan Amounts and Tenures

Micro to Large Loans

Loan apps cater to a wide range of borrowers, from those needing small-ticket loans (₹1,000–₹10,000) to those requiring up to ₹5,00,000.

Customizable Tenures

Unlike banks that offer fixed tenure slabs, loan apps provide flexible repayment options ranging from a few weeks to 60 months.

Benefits

Short-term gig workers benefit from micro-loans while salaried individuals opt for longer tenures based on EMI comfort.

5. Broader Eligibility Criteria

Inclusion for Gig Workers and Freelancers

While traditional banks often hesitate to lend to non-salaried individuals, loan apps use alternative credit scoring models to cater to:

- Freelancers

- Gig economy workers

- Self-employed individuals

Credit-Builder Loans

Some apps offer small loans to users with thin or no credit history to help build or improve their CIBIL scores.

6. Transparent Terms and Charges

All Charges Displayed Upfront

Loan apps usually provide a complete breakdown of:

- Interest rates

- Processing fees

- Late payment penalties

- Foreclosure charges

In-App Calculators

EMI calculators, amortization tables, and cost summaries are often built into the app, allowing users to understand what they’re signing up for.

Avoiding Misunderstanding

This transparency helps users avoid falling into a debt trap or unexpected charges.

7. Better User Experience and Interface

Intuitive Design

Loan apps offer user-friendly, mobile-first interfaces that simplify the borrowing process. With clear CTAs, status tracking, and auto-fill features, they cater to digital-native users.

Multilingual Support

Many top apps offer regional language support to cater to India’s diverse user base.

Accessibility Example

Apps like Navi and MoneyTap allow users to navigate in 8+ Indian languages, empowering users across states.

8. AI and Data-Driven Lending Decisions

Beyond Traditional Credit Scores

Many apps analyze alternative data such as:

- Digital transactions

- Mobile usage patterns

- Utility bill payments

This helps extend loans to the underbanked or those with no formal credit history.

Faster Underwriting

AI-based algorithms instantly assess risk, validate documentation, and approve loans—far faster than human underwriters in banks.

9. Competitive Interest Rates for the Right Profile

Dynamic Risk Pricing

Loan apps often personalize interest rates based on user profiles, credit history, and repayment capability, making them competitive for low-risk borrowers.

Special Offers for Repeat Borrowers

Loyal users or those who repay on time often receive better deals on subsequent loans.

10. Integration with Other Financial Services

One-Stop Finance Apps

Many digital lenders now integrate:

- Credit cards

- BNPL (Buy Now Pay Later)

- UPI payments

- Budget tracking

- Insurance

This makes them not just lenders but holistic financial wellness platforms.

11. Privacy and Data Security

Regulatory Compliance

Top loan apps are RBI-registered NBFC partners or regulated entities, following strict data protection norms.

Secure Platforms

Encryption, two-factor authentication, and biometric logins ensure safe and secure transactions.

12. Better Customer Support

In-App Chat and Helplines

Unlike banks where getting an appointment or clarification can be a task, loan apps offer:

- Chatbots

- 24×7 support

- Quick resolution turnaround

App-Based Complaint Tracking

Users can raise and track complaints without visiting branches.

Final Comparison: Loan Apps vs Traditional Banks

| Feature | Loan Apps | Traditional Banks |

|---|---|---|

| Speed | Instant to 24 hours | 3–7 business days |

| Documentation | Minimal, paperless | Physical, extensive |

| Eligibility | Broader (gig workers, freelancers) | Salaried, credit history required |

| Interface | Mobile-friendly, intuitive | Formal, branch visits needed |

| Transparency | High (app-based info) | Medium to low |

| Disbursal Time | Same-day | Delayed |

| Personalized Offers | AI-driven, repeat user discounts | Generic |

| Additional Features | UPI, budgeting, insurance | Limited |

Disadvantages of Using Loan Apps

While loan apps offer numerous advantages, they also come with certain disadvantages that borrowers should consider before applying.

1. Higher Interest Rates for Risky Profiles

Some loan apps charge very high interest rates—up to 36%—especially for users with poor credit history or limited income, which can lead to a debt trap if not managed properly.

2. Limited Loan Amounts

Loan apps generally offer smaller loan amounts compared to traditional banks. For users seeking higher-value loans, especially for business or home purposes, apps may fall short.

Buy Now : A-Z Blueprint To Mastering The Stock Market

3. Shorter Repayment Tenures

Many digital lenders offer short repayment periods, which may lead to high EMI burdens that strain monthly budgets.

4. Over-Borrowing Temptation

The convenience and speed of loan apps can lead to impulse borrowing, especially among young users, resulting in multiple loans and financial mismanagement.

5. Data Privacy Concerns

Some lesser-known loan apps may misuse user data or have unclear data-sharing policies. There have been instances of aggressive recovery tactics, data breaches, and unauthorized contact access.

6. Not Suitable for Long-Term Credit Needs

While ideal for emergencies or short-term needs, loan apps are generally not suitable for long-term financial products like home or education loans that require structured planning.

7. Inconsistent Customer Service

Although many apps provide 24/7 support, not all offer effective redressal. Users may face delays in resolving issues or unclear communication.

Conclusion: Why Loan Apps Are the Future of Borrowing in 2025

The rise of loan apps in India and beyond is not just a tech trend—it’s a redefinition of how people access credit. In a digital-first economy where users demand speed, flexibility, and transparency, loan apps are emerging as the go-to solution for personal financing.

While traditional banks remain relevant for long-term and larger loans, especially for home or education purposes, mobile loan apps dominate the personal loan segment by offering:

- Instant access

- Minimal requirements

- Customizable experiences

Borrowers must, however, ensure that they use RBI-regulated platforms, understand the terms clearly, and avoid over-borrowing. With responsible usage, loan apps can be a powerful financial tool in one’s digital arsenal.

Buy Now : A-Z Blueprint To Mastering The Stock Market

Disclaimer : This blog post is for informational purposes only and does not constitute financial advice. Please consult a licensed advisor before making borrowing decisions. The views and research in this article are based on publicly available information and current market trends as of 2025. The author is not affiliated with any financial institutions or lending apps mentioned.

Keywords: Benefits of Using Loan Apps – Benefits of Using Loan Apps now – Benefits of Using Loan Apps in 2025