10 Best Payment Gateways of 2025

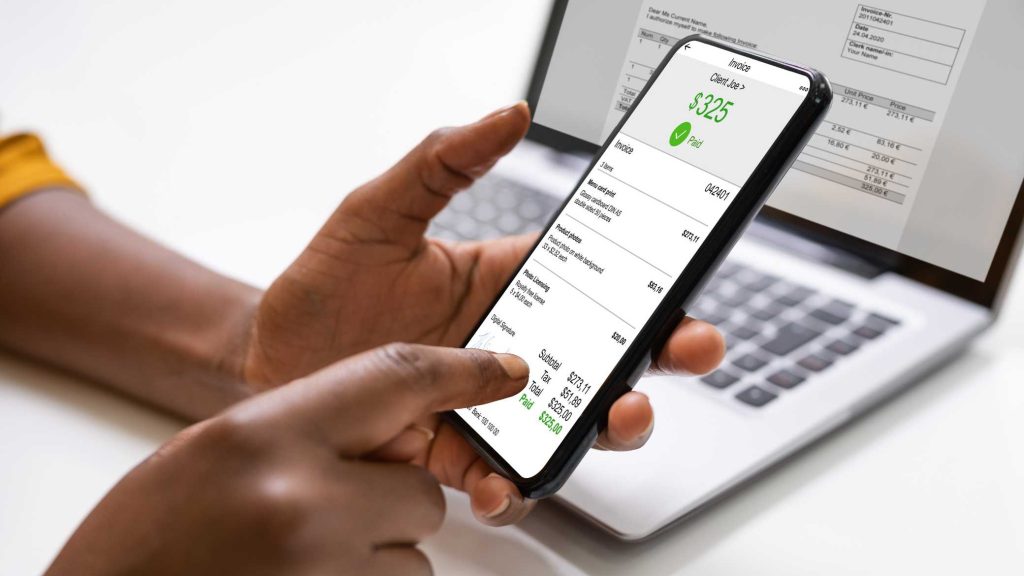

Best Payment Gateways : In today’s digital economy, a secure, reliable, and fast payment gateway is essential for any online business. Whether you run an e-commerce store, subscription-based service, or a freelancing platform, choosing the best payment gateway in 2025 can significantly impact your business’s success. With online transactions increasing worldwide, businesses must ensure seamless payment processing to enhance customer experience, prevent fraud, and boost conversions.

Table of Contents

This detailed guide explores the 10 best payment gateways of 2025, highlighting their features, benefits, pricing, and why they stand out in the competitive market.

What is a Payment Gateway?

A payment gateway is a technology that enables online transactions by securely processing payments between customers and businesses. It acts as a bridge between the merchant’s website or app and the customer’s bank or digital wallet, ensuring secure, encrypted transactions.

Key functions of a payment gateway include:

- Encryption – Protects sensitive financial data.

- Authorization – Confirms the availability of funds before completing a transaction.

- Settlement – Transfers funds from the customer’s account to the merchant’s account.

- Fraud Prevention – Detects and prevents suspicious transactions.

How to Choose the Best Payment Gateway in 2025?

When selecting the best payment gateway, consider these crucial factors:

- Security – Must comply with PCI-DSS standards and offer fraud protection.

- Global Acceptance – Should support multiple currencies and payment methods.

- Transaction Fees – Competitive pricing with no hidden charges.

- Integration – Easy API integration with websites, apps, and e-commerce platforms.

- Speed & Reliability – Fast transaction processing with minimal downtime.

Now, let’s dive into the top 10 payment gateways of 2025 that stand out in the online payments industry.

1. PayPal

Overview:

PayPal remains a global leader in online payment processing, serving millions of businesses across 200+ countries. It supports credit cards, debit cards, bank transfers, and digital wallets, making it a preferred choice for businesses worldwide.

Key Features:

✔ One-Touch Checkout – Faster payments with fewer clicks

✔ Multi-Currency Support – Accepts 100+ currencies

✔ Fraud Protection – Advanced security and chargeback protection

✔ Subscription Payments – Ideal for SaaS businesses

Pricing:

- Transaction Fee: 2.9% + $0.30 per transaction (varies by country)

- No monthly fee for basic accounts

2. Stripe

Overview:

Stripe is a powerful, developer-friendly payment gateway known for its customizable APIs and seamless integration with various platforms. It is widely used by startups, SaaS companies, and large enterprises.

Key Features:

✔ Custom Payment Flows – Supports tailored checkout experiences

✔ Machine Learning Fraud Detection – Reduces chargebacks

✔ Global Payments – Accepts 135+ currencies and payment methods

✔ Recurring Billing – Ideal for subscription businesses

Pricing:

- Transaction Fee: 2.9% + $0.30 per transaction

- No monthly fees, with custom pricing for high-volume merchants

Also Read :: How Reselling Works ?

3. Razorpay

Overview:

Razorpay is one of India’s top payment gateways, supporting UPI, cards, net banking, wallets, and international payments. It’s widely used by startups, e-commerce businesses, and service providers.

Key Features:

✔ Instant Activation – Easy onboarding for businesses

✔ UPI & QR Code Payments – Growing digital payment trends

✔ Subscription & Recurring Billing – Best for SaaS businesses

✔ Smart Analytics Dashboard – Detailed transaction insights

Pricing:

- Transaction Fee: 2% for domestic transactions, 3% for international transactions

- No setup or annual maintenance fees

4. Authorize.Net

Overview:

Authorize.Net (by Visa) is a trusted payment gateway, offering secure payment solutions for small businesses, retail stores, and enterprises.

Key Features:

✔ Advanced Fraud Protection – Multi-layer security

✔ Recurring Payments & Invoicing – Great for service-based businesses

✔ Mobile & Retail Payments – POS integration support

✔ 24/7 Customer Support – Live chat and phone assistance

Pricing:

- Monthly Fee: $25

- Transaction Fee: 2.9% + $0.30 per transaction

5. Square

Overview:

Square is an all-in-one payment processing solution known for its POS systems, online payment processing, and business financing options.

Key Features:

✔ No Monthly Fees – Pay-as-you-go pricing model

✔ POS & Mobile Payments – Best for brick-and-mortar businesses

✔ E-commerce Integrations – Shopify, WooCommerce, and Wix

✔ Fast Payouts – Same-day deposits available

Pricing:

- Transaction Fee: 2.6% + $0.10 per transaction

- No monthly or setup fees

6. Payoneer

Overview:

Payoneer is an excellent choice for freelancers, international businesses, and e-commerce sellers, enabling fast cross-border transactions.

Key Features:

✔ Multi-Currency Business Accounts – Get paid in different currencies

✔ Direct Bank Transfers – Withdraw funds easily

✔ Low Conversion Fees – Competitive exchange rates

✔ Marketplace Integration – Amazon, Fiverr, Upwork support

Pricing:

- Transaction Fees: 1% – 3% (varies by country and transaction type)

- Free account setup

7. CCAvenue

Overview:

CCAvenue is a leading Indian payment gateway that supports cards, net banking, UPI, wallets, and EMI options.

Key Features:

✔ 100+ Payment Options – Extensive local and international support

✔ Real-Time Transaction Monitoring – Prevents fraud

✔ Multi-Currency & Language Support – Boosts international sales

✔ Dynamic Routing for Faster Payments – Optimized transaction processing

Pricing:

- Transaction Fee: 2% – 3% per transaction

- No setup fee for startups

8. Braintree

Overview:

Owned by PayPal, Braintree is an advanced payment gateway offering seamless payment solutions for startups and global businesses.

Key Features:

✔ One-Click Checkout – Improves conversion rates

✔ Global Payment Acceptance – Supports 130+ currencies

✔ Customizable API – Tailored payment solutions

✔ Fraud Prevention Tools – Chargeback reduction

Pricing:

- Transaction Fee: 2.9% + $0.30 per transaction

- No monthly fees

9. 2Checkout (now Verifone)

Overview:

2Checkout (Verifone) is a powerful cross-border payment gateway supporting global merchants with multiple payment models.

Key Features:

✔ Subscription Billing & SaaS Integration

✔ Advanced Fraud Protection – AI-based detection

✔ Multiple Payment Methods – 45+ payment methods worldwide

✔ Seamless E-commerce Integration – Shopify, Magento, WooCommerce

Pricing:

- Transaction Fee: 3.5% + $0.35 per transaction

- No monthly fees

10. Instamojo

Overview:

Instamojo is an easy-to-use Indian payment gateway for small businesses, freelancers, and digital product sellers.

Key Features:

✔ Zero Setup Cost – Perfect for startups

✔ Instant Payouts – Get paid faster

✔ UPI & Wallet Integration – Supports major digital payment trends

✔ E-commerce Store Builder – Launch an online store easily

Pricing:

- Transaction Fee: 2% + ₹3 per transaction

- Free basic account

Best Payment Gateways – Conclusion:

Selecting the right payment gateway depends on your business needs, target audience, and transaction volume. If you want global reach, PayPal, Stripe, or Braintree are great options.

Buy Now :: Ecommerce Website With 100 Products

For Indian businesses, Razorpay, Instamojo, and CCAvenue are excellent choices. Evaluating transaction fees, security, and integration features will help maximize revenue and customer satisfaction in 2025.

Keywords : Best Payment Gateways – Best Payment Gateways 2025